Why banks must embrace proactive risk management with AI-driven RegTech

Reading Time: 5 minutes

Large firms spend up to $10,000 per employee annually on compliance, averaging around $300 million annually.¹ This significant investment could be redirected toward strategic priorities like technology upgrades, employee training, or market expansion.

AI-driven RegTech reduces compliance costs, allowing organizations to reallocate resources to strategic investments. Beyond cost savings, it enhances reputation and risk management, improves accuracy, and streamlines regulatory processes.

Robust data management: The backbone of AI-driven RegTech

The foundation of effective AI-driven RegTech is in robust data management and advanced analytics capabilities. High-quality, integrated data is essential for these systems to accurately assess risks, detect compliance issues, and generate reliable forecasts. Without comprehensive, clean, and well-structured data, even the most sophisticated AI algorithms will underperform. According to an IBM research publication, Overview and Importance of Data Quality for Machine Learning Tasks, AI systems are only as good as the data they are trained on.²

Advanced analytics solutions such as risk classification models, automated audit trail analysis, and predictive modeling are crucial in converting raw data into actionable insights. These enable banks to consolidate information from various sources, providing a comprehensive view of their risk exposure. Data analytics also power the adaptive learning capabilities of AI models, ensuring they remain effective as regulations change. The ability to provide transparent AI decision-making processes – a key requirement in the heavily regulated banking sector – also depends on sophisticated data analysis.

How are banks today using AI-powered Regtech

A bank can use AI-powered RegTech to monitor transactions and identify suspicious activity in real-time. If AI systems detect a suspicious transaction, it can escalate the issue to the compliance team for further investigation. Similarly, an insurance company can use RegTech to analyze customer data and identify potential risks, allowing it to offer more personalized and relevant products and services.

- Automated compliance reporting: RegTech solutions leverage AI to automate the generation of compliance reports. This approach significantly reduces manual effort, minimizes human error, and speeds up reporting processes. By quickly and accurately processing large volumes of data, these systems ensure more timely and reliable compliance reporting.

- Enhanced fraud detection: Advanced AI algorithms power RegTech platforms to monitor transactions and flag anomalies that may indicate fraudulent activities. These systems analyze patterns across vast datasets, identifying subtle irregularities often missed by human analysts. The outcome is improved fraud detection accuracy, fewer false positives, and quicker responses to potential threats.

- Streamlined risk assessment: AI-powered RegTech solutions conduct thorough risk assessments by analyzing extensive data from multiple sources. This technology swiftly processes complex information, offering a comprehensive view of an organization’s risk landscape. Consequently, businesses can implement more proactive risk management strategies and prevent potential compliance breaches before they materialize.

AI-driven RegTech’s impact on trade surveillance

Traditional trade surveillance reporting is often delayed, uses inflexible formats, and struggles to meet compliance requirements, while alert generation systems fail to adapt to changing market conditions, missing complex or emerging manipulation tactics. However, AI surveillance can address these challenges by adapting to market changes in real-time, detecting complex manipulations, and streamlining compliance reporting

Alert generation

AI significantly enhances alert generation by employing advanced techniques such as Cognitive Market Monitoring and Anomaly Detection. These tools leverage AI trained on historical data to recognize complex patterns of market abuse, such as spoofing or insider trading. Additionally, Smart Threshold Calibration dynamically adjusts alert thresholds based on market conditions, time, and asset class, maintaining high sensitivity while minimizing false alarms.

Alert evaluation

AI significantly enhances alert generation by employing advanced techniques such as Cognitive Market Monitoring and Anomaly Detection. These tools leverage AI trained on historical data to recognize complex patterns of market abuse, such as spoofing or insider trading. Additionally, Smart Threshold Calibration dynamically adjusts alert thresholds based on market conditions, time, and asset class, maintaining high sensitivity while minimizing false alarms.

Alert reporting

In alert reporting, AI automates and optimizes compliance documentation and communication processes. Automated compliance mapping links alerts to specific regulatory requirements across jurisdictions, ensuring comprehensive coverage. Generative AI enhances reporting by creating detailed, regulation-specific narratives that incorporate necessary legal terminology. AI also offers smart summarization to distill complex technical and regulatory information into clear, concise language.

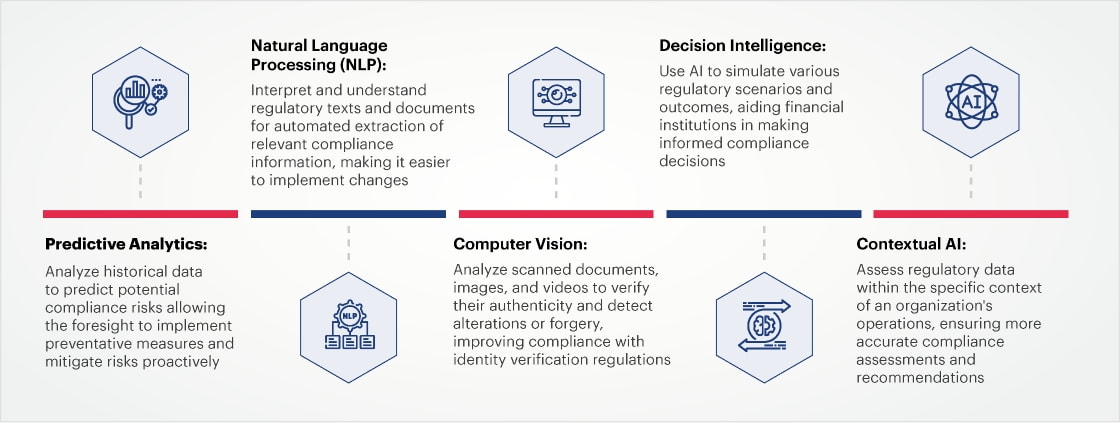

AI technologies reinventing financial compliance and risk management

AI is significantly improving how financial institutions handle compliance. Using machine learning, natural language processing, and generative AI, it can process vast amounts of data to detect and prevent financial crimes like fraud and money laundering. It also helps companies manage risks, monitor transactions, and meet regulatory requirements. Here are the key AI technologies enhancing RegTech capabilities:

Suptech: RegTech’s next evolution

Suptech (Supervisory Technology) is a subset of Regtech, focusing on advanced analytics, sentiment analysis, network analysis solutions, and speed-to-text tools. Suptech enhances regulatory oversight by providing tools for more effective supervision and faster regulatory responses.

Conclusion

The era of traditional compliance is over. AI-driven RegTech is reshaping how financial institutions manage risk and navigate complex regulations. However, the success of AI-driven RegTech relies heavily on a strong data foundation. To build this foundation, banks need the right technology, processes, and talent. This is where Sigmoid can help. Our expertise in data and analytics ensures that financial institutions are equipped with the tools and knowledge needed to harness the full potential of AI-driven RegTech. The future of compliance is here, and it’s driven by innovation and agility. The time to adapt is now.

About the author

Shyam Nadig is the Global Head of capital markets at Sigmoid. Shyam has over 25 years of work experience spanning business process operations, service delivery, sales, marketing, and P&L. He is currently running transformational projects around regulatory compliance, cloud modernization, and data quality for key capital markets’ clients. In these initiatives, Shyam leverages Sigmoid’s proprietary methodologies and toolkit to deliver unique value propositions to clients.

- https://www.forbes.com/sites/servicenow/2021/10/21/the-creeping-cost-of-compliance/

- https://research.ibm.com/projects/data-quality-in-ai

Featured blogs

Subscribe to get latest insights

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI

Featured blogs

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI