How to elevate digital banking experiences for customers with data analytics

Reading Time: 5 minutes

From data silos and security concerns to poor data quality and ineffective segmentation, retail banks today face a myriad of challenges in their quest to deliver customer-centric digital experiences.

According to a recent survey, 80% of customers now expect their bank to offer a seamless digital experience.¹ As these demands grow, banks must find innovative ways to enhance customer experience (CX) and stay competitive. This is where data analytics steps in, offering powerful solutions to bridge these gaps and transform the digital banking landscape.

Overcoming data challenges that become CX roadblocks

Banks face critical data challenges that hinder seamless and personalized customer journeys. Here’s how they can tackle these issues head-on and transform their customer interactions.

47% of banking customers are inclined to open accounts with big tech players as traditional banks struggle to provide smooth, personalized, and digital customer journeys.²

Source: Forrester

- Data silos & fragmented data

One of the primary challenges in traditional banking is the existence of data silos. Fragmented data across various banking systems can severely hinder customer insights. For instance, customer transaction data, loan records, and interaction history might be stored in separate databases, making it difficult to form a comprehensive view of the customer.

To overcome this, banks must adopt strategies for data integration such as implementing a centralized data management system that can unify disparate data sources, providing a holistic view of the customer.

- Data security concerns

Customers are increasingly concerned about the privacy and security of their personal information. Banks must ensure that data handling practices are secure and comply with regulations such as the General Data Protection Regulation (GDPR).

By prioritizing data security and committing to responsible data practices, banks can build trust with their customers. This involves using encryption, implementing strong access controls, and regularly auditing data security measures to prevent breaches and protect sensitive information.

- Poor data quality

Poor data quality can lead to frustrating customer experiences. Inconsistencies, errors, or missing information, especially during data migration or manual entry, can result in misdirection of funds or misguided financial advice.

Banks need to establish robust data cleansing and quality control processes. Regularly validating and updating data ensures accuracy and reliability. By maintaining high-quality data, banks can provide precise and helpful services, enhancing customer satisfaction and trust.

- Ineffective customer data segmentation

Accurate customer data segmentation is crucial for delivering personalized experiences. Without it, banks risk sending generic marketing messages and irrelevant product recommendations, which can disengage customers.

Effective customer segmentation strategies involve analyzing relevant data points such as demographics, financial habits, and product usage. This allows banks to tailor their offerings and communications to meet the specific needs and preferences of different customer segments.

Data-driven trends redefining the digital banking experience

As financial institutions navigate the complexities of the digital age, three key data-driven trends are emerging as game-changers. These trends are not only revolutionizing the way banks operate but also reshaping the customer experience.

- Generative AI for personalization and customer support

Generative AI-powered chatbots and virtual assistants provide efficient, 24/7 customer support, resolving queries and issues in real-time without human intervention. This shift towards AI-driven personalization and support is setting new standards in customer experience, positioning banks to meet the evolving demands of tech-savvy consumers.

Generative AI-powered assistant

A major investment bank has launched an AI-powered assistant, leveraging OpenAI technology, to support its 16,000 advisors. This advanced tool provides consultants access to over 100,000 reports and documents, making information retrieval effortless. The generative AI-driven chatbot efficiently manages a variety of research and administrative tasks, enabling advisors to focus on delivering personalized financial advice and fostering stronger client relationships.

- Real-time payments

Real-time payments eliminate the delays associated with traditional banking processes, reducing the risk of fraud and errors. For businesses, this means faster settlements and improved operational efficiency, while consumers enjoy the benefit of instant transactions. As real-time payment systems become more widely adopted, they are poised to become a cornerstone of modern banking, driving innovation and competitiveness in the financial sector.

Instant transfers

The UK’s Faster Payments Service (FPS) enables real-time transfers between bank accounts, allowing businesses and consumers to send and receive funds instantly, thereby improving cash flow and reducing the risk of late payments.

- Data monetization

By analyzing customer data, banks can uncover valuable insights to develop new revenue streams and optimize product offerings for effective data monetization. This involves not only selling anonymized data to third parties but also using data analytics to create more targeted marketing strategies and personalized financial products.

New revenue streams

A leading financial institution uses data analytics to monetize customer data by offering personalized credit card and loan products, optimizing marketing campaigns, and providing anonymized transaction data to retailers for consumer behavior insights, creating new revenue streams and improving service offerings.

4 key benefits of data and analytics in customer-centric banking

- Hyper-personalization

Data and analytics services enable banks to create personalized experiences by analyzing individual customer behavior and preferences. For example, by examining a customer’s spending habits, banks can recommend budgeting tools or suggest savings accounts that align with their specific financial goals. This tailored approach ensures that customers receive relevant and useful advice. - Proactive customer service

Predictive analytics empower banks to anticipate potential issues and proactively address them. By identifying patterns of suspicious activity, banks can alert customers to possible fraud attempts before any damage occurs. This proactive approach not only protects customers but also builds trust and confidence in the bank’s ability to safeguard their financial well-being. - Improved User Experience

Advanced analytics help banks optimize their digital platforms by understanding user behavior and identifying areas for improvement. By analyzing user clicks and navigation paths, banks can pinpoint pain points and streamline functionalities, making the platform more intuitive and user-friendly. This enhances the overall user experience, reducing frustration and increasing customer engagement. - Increased operational efficiency

Data-driven insights streamline internal processes, reducing the need for manual intervention and speeding up transactions. For instance, automating loan approvals and customer inquiries based on data analytics can lead to faster resolutions and significant cost savings. This increased operational efficiency not only improves service delivery but also allows banks to allocate resources more effectively.

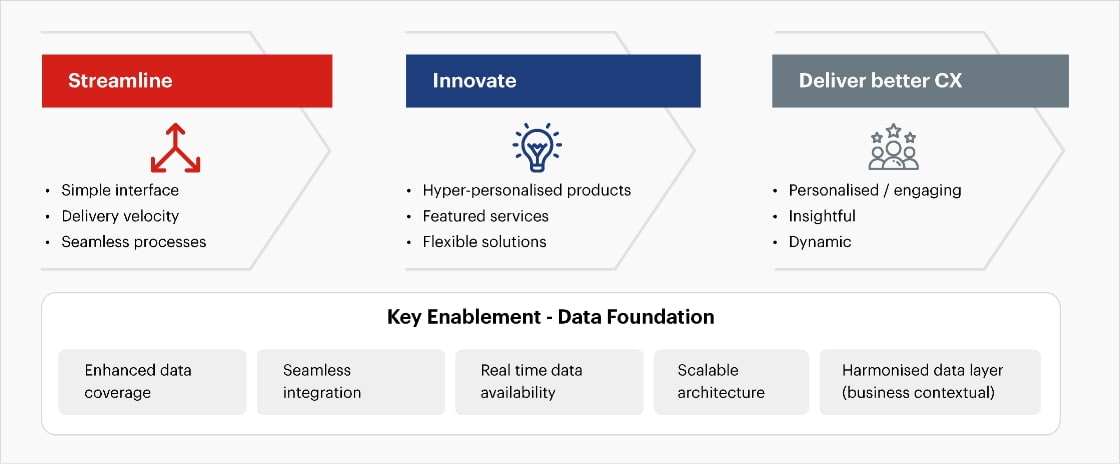

Sigmoid’s CX improvement framework for banking

Our CX improvement framework is designed to transform customer interactions through three core components: simplification, innovation, and enhanced customer experience (CX). At its foundation lies a robust data infrastructure, ensuring comprehensive data coverage, seamless integration, real-time availability, scalable architecture, and a harmonized data layer. This powerful combination enables banks to streamline processes, foster innovation, and ultimately elevate the customer journey to new heights.

Conclusion

The future of CX in banking is not just about transactions; it’s about creating a symbiotic relationship between customers and their financial institutions, where data-driven insights fuel continuous improvement and innovation. The convergence of advanced data analytics, artificial intelligence, and real-time technologies will usher in an era of hyper-personalized, predictive banking. We can envision a not-so-distant future where banks evolve into proactive financial companions, anticipating customer needs before they arise and offering tailored solutions in real-time.

Featured blogs

Subscribe to get latest insights

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI

Featured blogs

Talk to our experts

Get the best ROI with Sigmoid’s services in data engineering and AI